According to recently published data, property owners in Dallas County can expect to save more than $499 million in property taxes in 2023.

The Dallas Central Appraisal District’s estimate provides the grounds for determining the market value of both real estate and personal property each year. Regardless of a gain or fall in value, property owners are urged to protest the figures annually. Based on the preliminary and up-to-date tax data supplied by the Dallas Central Appraisal District, O’Connor put together this data.

O’Connor anticipated that Dallas County property tax protests would ultimately save $650 million in property taxes by 2023 before the final tax values were determined. Based on a review of information from the Dallas County Property Tax Trends report on the reduction in property taxes from 2021.

The amount that homeowners would save in property taxes for 2023 has been revised, and it is now $35 million, an increase of $10.9 million savings over the residential property tax savings originally projected based on values released in July 2023. According to the adjusted figures from the Dallas Central Appraisal District, a total of 40,756 homes have had their values reduced as an effect of 2023 tax challenges. The average assessment drop currently stands at $32,628 with a 2.7% tax rate. Property taxes on each home will be reduced by an average of $881. (Homestead exemptions are not accounted for.)

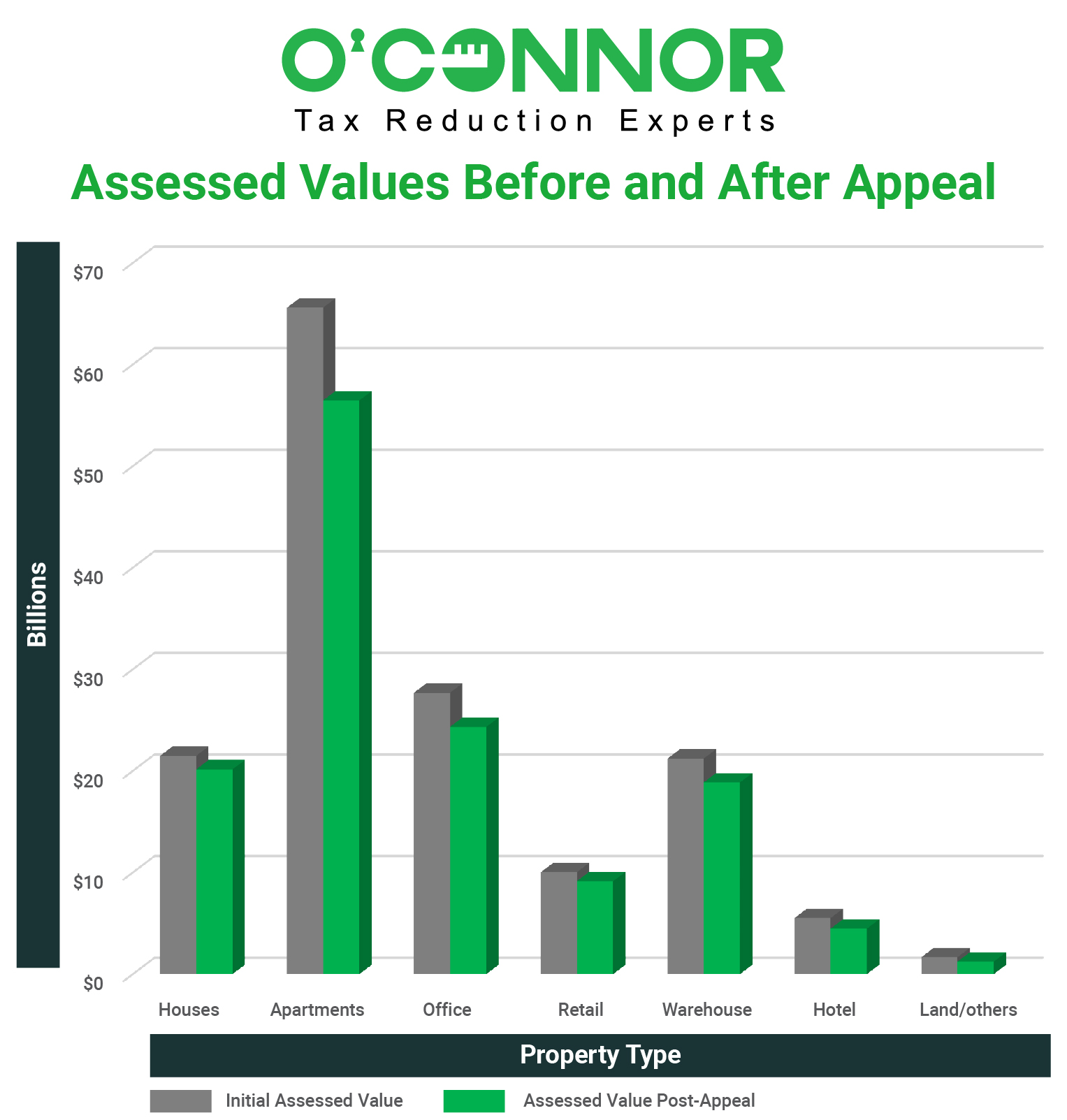

The most cost-effective commercial real estate as of September 2023 in terms of real estate taxes and tax protests will be apartments, as predicted by earlier studies. The final tax objections for 2023 were settled at a value of $56.4 billion, compared to the initial value of $65.5 billion, resulting in a $9.1 billion reduction in tax assessments. With a tax rate of 2.7%, apartment owners saved a total of $246 million in property taxes this year. In Dallas County, tax reductions for apartments reached 13.9% in 2023. Average apartment complex appeals resulted in a property tax reduction of $80,274. These values are the result of 3,072 hearings for apartments for the 2023 property tax year.

In 2023, a total of 5,667 accounts have reached settlement for accounts categorized as land and other business properties. The current notice value for 2023 stands at $1.23 billion, which is a decrease of $429 million from the original value of $1.66 billion. With a tax rate of 2.7%, the land/other owners can expect tax savings of $11.6 million for this property tax year. This equates to $2,048 per tax parcel based on the finalized tax values. Among Dallas County business property tax savings, land/other properties receive the highest percentage assessment at 25.9%.

The assessed values for hotels that presented objections, using the most recent 2023 figures, have decreased from $5.5 billion to $4.4 billion. This represents a total tax assessment decrease of $1.04 billion and results in tax savings of $28 million, based on a 2.7% tax rate. In total, there are 456 hotel properties included in this analysis, leading to an average property tax savings of $61,617 per resolved hotel property in 2023. For objections resulting in a decrease, the final percentage reduction for hotel property taxes as of September 2023 is 18.9%.

As of September 2023, office buildings in Dallas County continue to hold the distinction of having the second-highest total of property tax savings. The total savings amount to $90.6 million for a total of 1,843 office buildings. Initially valued at $27 billion, the final value was reduced to $24 billion, resulting in a significant tax decrease of $3.35 billion. The settled property tax amount for 2023, based on a tax rate of 2.7%, is $49,182. The assessment drop for office buildings is 12.1%, reflecting the successful resolution of objections for a number of office buildings as of September 2023.

The 2023 property tax protests in Dallas County were a success, leading to a decrease in property taxes for 58,267 owners. The initial assessed value of $154 billion dropped to $134 billion, resulting in an average decline of 12.08%. As of September 2023, the total tax savings per property that was objected to, encompassing both residential and commercial properties, amounts to $8,574.

The following apartments have been updated to reflect the ones that have experienced the greatest reduction in their 2023 property tax assessments:

- The National Residences apartments are situated at 1401 Elm St. in Dallas, Texas. In the 2023 tax year, they are expected to benefit from tax savings amounting to $5.13 million. Their initial property tax assessment of $395 million was significantly reduced to $205 million, resulting in a notable difference of $190 million. As a result, this uptown Dallas apartment property, which was constructed in 1965, experienced a substantial 48% decrease in property taxes.

- The apartments at 9382 Whistle Stop Pl in Dallas, Texas had an updated initial property tax assessment of $100 million in 2023; this assessment was then decreased by $53.1 million, bringing the current total value for their 2023 property tax assessment to $47.5 million. Lenox Lake Highlands, an apartment building with 403 units, was constructed in 2021.

- The property tax assessment for Selene Apartments, situated at 2620 Maple Avenue in Dallas, Texas, has seen a significant decline in the year 2023. The assessment has gone down by $49.6 million, representing a decrease of 43%. Previously valued at $114 million, the property is now valued at $65 million. As a result of this reduction, the property taxes have been lowered by $1.34 million, which was calculated using a tax rate of 2.7%.

The possibilities of property tax savings attainable through the property tax protest process are illustrated above with examples. The original values provided by the Dallas Central Appraisal District were compared to the most recent tax assessments for the final tax year to determine the completed 2023 property tax assessment reductions. The Dallas Central Appraisal District, which will appraise all of the real estate in Dallas County, employs more than 240 employees. (This information excludes properties that have been protested but not reduced, which raises the average decrease.)

When property owners challenge their property tax assessments each year, their chances of receiving reductions improve. In an average year, well over half of the Dallas County property tax protests are successful.